When it comes to choosing an investment property in London, there are so many things to consider – what type of property will generate better returns? How to predict the best areas worth investing in? Where's the best rental yield in London? Is there a particular aspect that ensures increased desirability for a buy-to-let investment?

The list of potential considerations can seem endless. So we asked Mark Goodeve-Docker, our New Homes and Investments Director, to talk us through some of the factors that might help to identify where it's best to invest in a property in London depending on the type of investor you are. Here is your Property Investment Guide for London.

How to ensure a good return on investment

Mark: Return on investment constitutes two sides: capital growth, which is a profit made on an investment, measured by the increase in its market value over the invested amount; and rental yield, which is a rate of return from an investment (what you are getting on a monthly basis).

Looking at rental yield, ensuring a demand for your property is essential.

For example, Apple will be bringing its HQ to Battersea Nine Elms in the next few years, which means that its employees will be looking for accommodation, ideally nearby.

Canary Wharf is set to expand, bringing more companies in, which once again indicates increased demand for property.

Universities and good colleges also inflate demand for rental properties within easy reach. So to gauge the potential level of demand, looking at a prospective area in detail and researching future plans for the area is necessary.

First thing to look at in a potential investment property

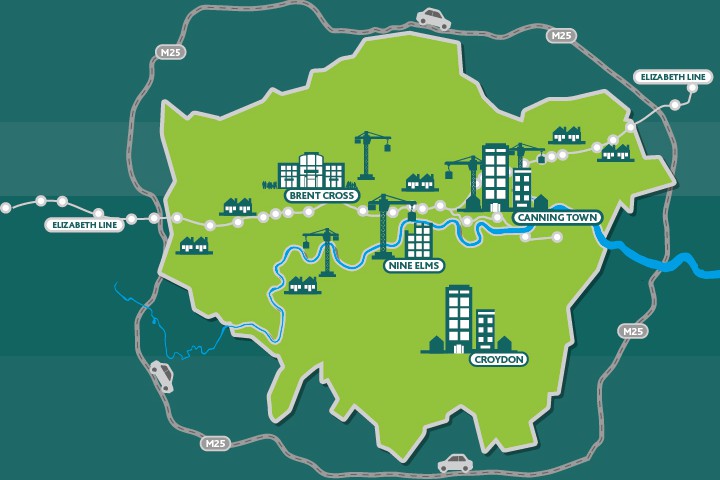

Mark: Location, location, location. To be more specific, proximity to key transport links – tube, train or Elizabeth Line (formerly Crossrail) station – anything that would give a tenant mobility.

It's common knowledge that 75% of tenants want to live within 5-10 minutes' walk of a local transport hub and most want to be within a 30-40 minute commute to work.

This is why areas around the Elizabeth Line stations have seen stronger price growth than the surrounding areas and present a fantastic investment opportunity.

"If you see a lot of cranes and hoardings in the area, it’s a good sign"

How to identify the best areas to invest now?

Mark: Simply speaking, if you see a lot of cranes and hoardings in the area, it’s a good sign. This is an indication that regeneration is taking place, developers are coming to the area and household names are taking up retail and commercial spaces – which is also a sign that the local property prices are set to increase.

Examples of areas include Croydon, Colindale, Royal Docks and Canning Town, which are expected to generate good returns on an investment, given that there is an anticipated increase in property prices due to regeneration plans.

Investing in a new build property

"New build homes will start generating a steady return immediately"

Mark: Consider what type of investment you are looking to make. New build homes can be built in an already established area, with existing infrastructure and an established community. Despite their higher initial price, this can be a safer investment option that will start generating a steady return immediately.

Another option is to invest in an area that is undergoing regeneration.

This type of investment might not bring an immediate return and is considered a slightly riskier option, but it will usually bring a better long-term dividend overall and the initial investment required will be lower.