You’re going to hear a lot about rising interest rates, but let’s talk about the opportunity.

Coming off the back of inflation, there has been a lot of talk on raising mortgage interest rates. Nothing is certain, but most forecasters now predict one interest rate rise in November, from 0.1% to 0.25%, then likely another sometime Q1 2022. To understand the concerns and opportunities present right now, there are a few things you ought to know.

The All-Time Low

This all revolves around the Bank of England’s (BOE) base rate. The base rate influences the mortgage rates that lenders offer to customers. Inflation has risen above the official BOE target of 2% – in the last official report in August, it was at 3.2%. Forecasters suggest the base rate will go up in order to allay the rising inflation rate.

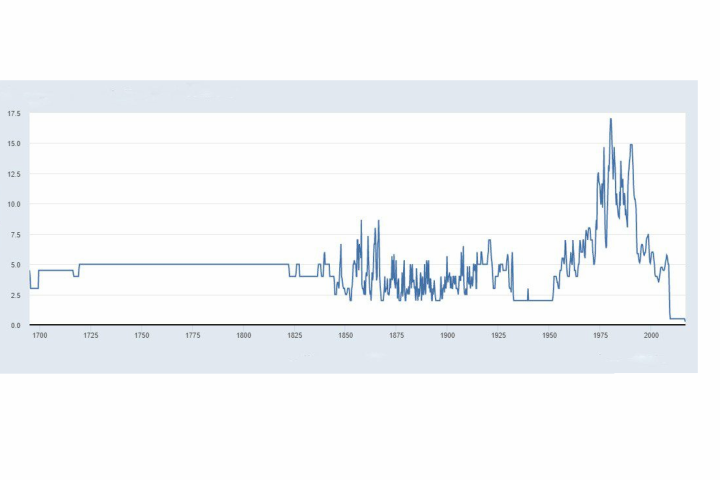

But first, let’s talk about the base rate. It’s currently at 0.1%, which the lowest it’s been in around 300 years.

To give you some context, in the 1980s, the base rate ranged between 10% and 15%. Rates decreased gradually into the single digits in the 1990s, and then, with the global recession in 2008, the BOE had its most sudden drop – all the way down to 2.0%. At the time, that was unbelievably low. Since then, with the global financial crisis, headlines touted 0.75%, and then 0.5%, and then 0.25% as the new all-time low.

What that means is, even if the BOE’s base rate rises from its emergency pandemic rate of 0.1% up to 0.25% in November and a little higher in Q1 2022, it will still be so low, it was unheard of 5-10 years ago. So when we’re all about to see worrying stories in the news and social media, sensationalising the increase and panicking over how homeowners and buyers will cope, you don’t have to panic. It will still be one of the lowest rates in 300 years, and mortgage finance is set to remain very cheap for the foreseeable future.

A little added complexity

For those who want to dig a little deeper, let’s talk a bit about SWAP rates. These are the rates at which banks lend to each other, and they can rise and fall based on what the banks predict will happen in the markets. These SWAP rates then determine the mortgage rates that lenders charge on the majority of their fixed rate products. These SWAPs have increased by 0.2-0.3% in the last month alone, suggesting the financial markets are already pricing in an increase in interest rates.

Despite the SWAP rate increase, our mortgage broker, Alexander Hall has recorded a combination of increases and, surprisingly, decreases in mortgage rates this past week. For clients with lower deposits, who suffered higher rates after the apex of the pandemic because mortgage lenders deemed these mortgages slightly riskier, rates are still trending downward. This highlights how mortgage lenders are confident in the forecasts for the housing market and house prices. For those at a higher income, Alexander Hall has found multiple high street names, including Halifax, HSBC and Barclays, all enhance their criteria to offer 5.5x income. With the average house price now at over 8 times earnings, and this figure being even higher in London, these criteria changes are positive for many prospective buyers. So, even with the forecasted interest rate rise, we see banks reacting confidently in the property market, which may continue in the coming weeks.

Now for the opportunity…

The current base rate has provided opportunities for many to access low mortgage rates, however even with the suggested base rate rise, low mortgage rates will remain widely available, across the market, into November and beyond. Lender competition is expected to remain fierce, so for those still deciding whether to go ahead with their home moves, there’s still plenty of time to access affordable borrowing rates.

Your next steps

A good mortgage broker can find you the best of these competitive rates – like Alexander Hall, one of the UK's top mortgage brokers. If you're looking to buy that home you've been dreaming of while rates are low, contact the Foxtons team of property experts, who can make that dream a reality. With our proprietary technology and expert agents, we can help you take advantage of the current market conditions. If you’d rather make your move in the coming months, get an up-to-date valuation from Foxtons, so you can plan ahead, knowing what your property can achieve in today’s market.