Coming into this year, there was a lot of talk about the softening market, and how difficult it would be on homeowners with plans to sell. If you’re considering putting a property on the market, we have good news for you. We’ve reached the end of Q1, and the dependable appetite for London homeownership is providing new hope.

Foxtons annual report, The London Report 2023 was recently released. In it, we discuss the wary predictions ahead of the 2023 market and the encouraging ways London has diverged from them:

- The jobs market remains robust

- Recession is expected to be shallow and short

- Inflation has peaked

- Forecasts for interest rates have pared back

- Mortgage rates are settling at 4% instead of the predicted 6%

First-time buyers, it seems, have a big part to play in keeping the market moving this year:

‘Although the rise in living and mortgage costs will deter some first-time buyers, the rising rental market is encouraging some to make the decision to buy, boosted by first-time buyer stamp duty exemptions under £425,000 and a reduced fee up to £625,000.’

Rightmove’s recent House Price Index served to confirm these predictions; showing the number of sales agreed rising to pre-pandemic levels, led in London by the sale of typical first-time buyer homes like one- and two-bed flats (Rightmove article).

Flats are back

If you’re trying to sell a London apartment, 2023 may be the year for you. Especially when the pandemic hit, buyers were romanced by homes with buckets of additional space. This year, with buyers focussing on the best value for price, London flats may be in vogue once again (Zoopla article). We have already seen a start in 2022, with a 40% annual increase in sales of studio and one-bed apartments in Zone 1. (The London Report 2023, 'Growth of Commutable London').

What motivates buyers in 2023?

Needs must

For many of us, buying and selling property is a needs-based decision. Our families grow, we need to be near good schools, we have new jobs and new commutes, the kids move out, we retire…and to accommodate the changes in our lives, we move house.

Best bet

‘One in every two apartments now sells with a nil rate [no stamp duty tax], up from just one in four before the change in September.’

~ The London Report 2023

Lately, there’s also been high demand and low stock putting upwards pressure on rent prices.

Combined with the current increased stamp duty savings for first-time buyers, there’s good reason for renters to put in their notice and take that first-step on the property ladder.

Moving on up

While needs-based buying is here to stay, there’s also no such thing as bad press for the London property market. When the media predicts the market softening, buyers interested in entering or upgrading in the London market see opportunity in neon letters. 2023 is a great market for upsizing because, “the discount on the house being sold will usually be less in monetary terms than the one being purchased.” (The London Report, pg 2).

There are two big trends that affect second-steppers upsizing in the market – demand is increasing at the lower end of the market, so those first-time buyers homes they bought last time will find favour in the 2023 crowd. There’s also an increase in choice and repricing at the upper end of the market, as Zoopla’s House Price Index uncovered, “This is seeing sales agreed at 4% lower than asking price – or £14,000 on average – which equates to the greatest savings on higher-priced properties” (Zoopla article).

The long game

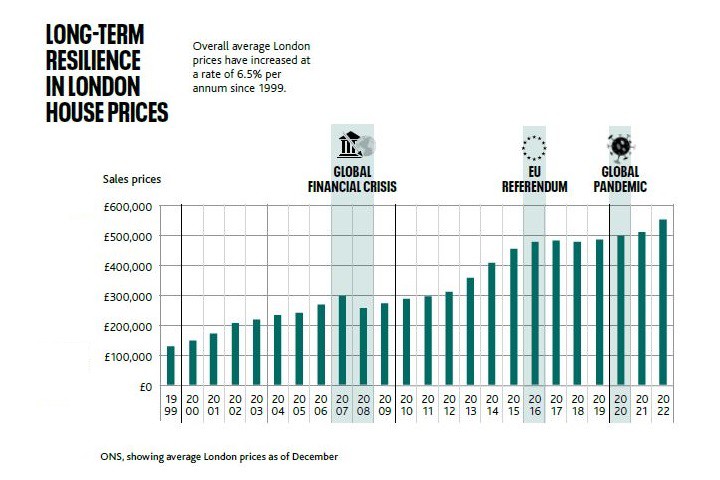

Whether you’re a buyer, a seller or both, London property has an attraction past the sash window and tiled walks, the amenities of the Capital and the iconic river running through it…If you’re just looking at the numbers, the reason you want to transact is London’s long-term resilience. Nothing – be it a global financial crisis, EU referendum or global pandemic – has been able to stop London’s long-term house price growth in the last 20 years. It has naturally limited stock and massively global appeal.

If you’re selling, let’s get started.

Buyer demand is much more robust than anyone initially predicted for 2023 – and our Negotiators can make the most of it to achieve your property sale. Our applicant levels are up and our buyers are active. Unlike other agencies, all Foxtons offices across London are linked together, so we can move these active buyers and show them homes they’ll fall in love with, no matter which Foxtons office they walked into.

Book a valuation with our local expert to see what your property can achieve in this unique market.