The London lettings market continues to offer healthy yields for landlords and investors, although tenants have benefited from improved renting opportunities in Zones 3 to 6 and an increase in properties available to rent.

These are the findings of the Foxtons London Lettings Report for Q3 2016, the first in a series of quarterly reports focused on the capital’s rental market.

Thanks to our status as London’s leading estate agent, we’re able to use data on active tenancies – rather than those listed to rent – to provide a clearer and more in-depth picture of London’s lettings market.

While you can read the full report here, we’ve highlighted some of the key findings below.

A rise in the number of rental properties

The number of properties available to let in London has steadily increased over the course of the year.

This rise could be attributed to a number of factors, including buyers putting off selling their property until there is an uplift in the sales market, a surge in buy-to-let properties bought before the stamp duty changes in April, and the EU referendum affecting corporate relocation lettings, as there remains uncertainty around Britain’s position in the EU.

This increase has had an impact on rental values.

While properties in Zones 1 and 2 have seen a decrease in their rental value, properties in Zones 3–6 have been less impacted by this saturation of the market.

In particular, larger properties with 3 or more bedrooms in Zones 3–6 have actually experienced an increase in value to an average of £507 per week, which is up 3.5% compared to the same quarter in 2015.

We want to live above the ground floor

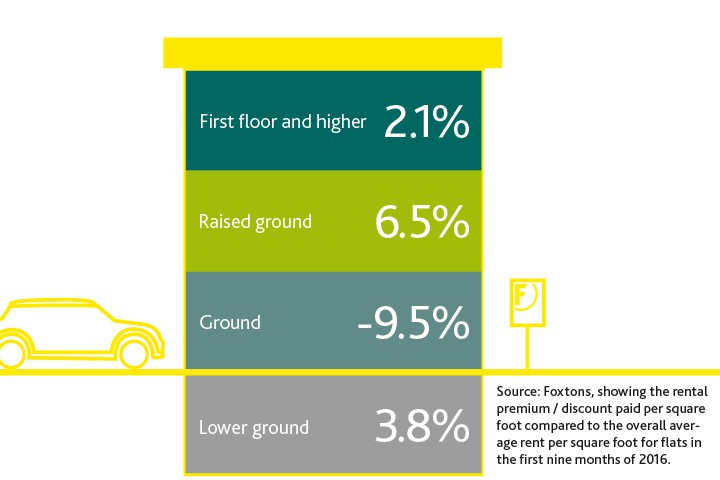

The research also shows that tenants are willing to pay a premium for flats on the raised ground floor or higher.

The price paid for properties on the first floor or higher was at a 2.1% premium, based on the average price paid per square foot. And those on the raised ground floor benefited from a price premium of 6.5%.

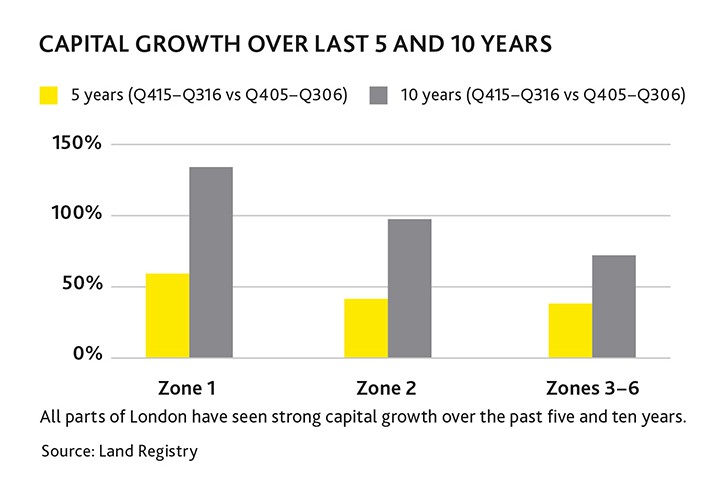

London property is still a sound long-term investment

While rental values have fallen slightly in Zone 1, it is here that properties have seen the highest capital growth, with growth at around 130% in the past 10 years.

However, it’s also interesting to see that in the last 12 months, 75% of property sales have been in Zones 3-6.

The way we rent is changing

In Zone 1, a higher proportion of individuals rent alone compared to the other London zones. In Q3 of 2016, over 40% of all properties in Zone 1 were occupied by one tenant, with less than half this number in Zones 3–6 at around 20% of all active tenancies.

However, this number is declining and we’re seeing more people house sharing in order to reduce overheads.

Discover more...

Read the full report, take a look at our new homes properties perfect for investors, or book your free valuation today.