According to the latest Foxtons London Lettings Report for Q2 2017, the London lettings market remains strong following a slowdown in the sales market over the past year. While average rental prices have experienced downward pressure, long-term investment in the London property market still produces healthy total returns.

Falling stock levels = higher ratio of renters

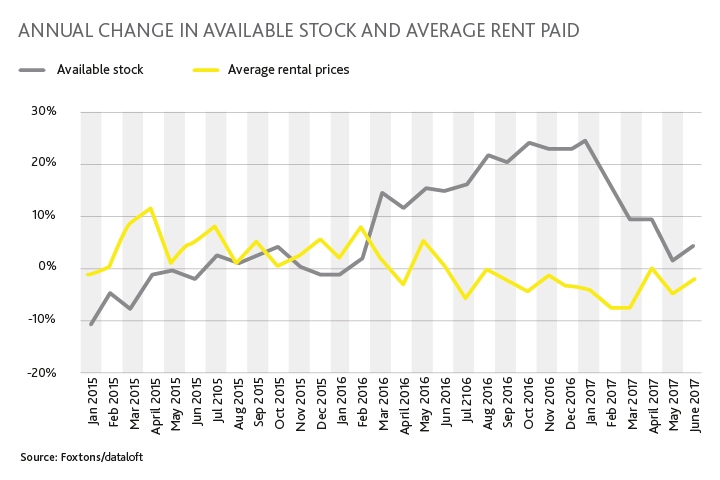

We had previously seen a rise in stock levels, as more people turned to letting their property instead of selling it during uncertain times.

But these stock levels seem to be easing back and the number of renters registering with Foxtons per newly instructed property has risen slightly from 6.1 to 6.3 in Q2 2017.

With a higher ratio of renters to properties, we would expect to see a slower pace in rental price decline. This is true in Zones 1 and 2, where average weekly rents fell by 1.6 and 1.2% respectively year on year.

However, in Zones 3-6 average rental prices decreased much more at 5.2%, compared to Q2 2016.

Zone 2 is still the most popular place to rent

While average rents for all property types and sizes in London have fallen on the whole, properties in Zone 2 were least affected and even saw an upward trend in average rents for studios and two bedroom flats.

And although Zone 1 is the only zone to see growth in the number of rental searches, Zone 2 has the highest proportion of renters searching for a property at 39.3% of London’s total renters market.

Renters will also pay a 21.9% premium in Zone 2 for a furnished property, compared to 7.8% in Zone 1 and 12.7% in Zones 3-6.

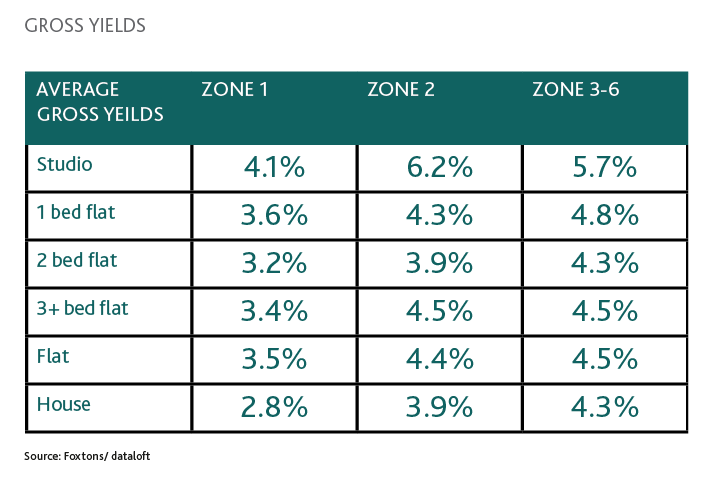

Zones 3-6 show highest gross yields

While rental prices remain suppressed, annual returns for London property are still strong and continue to show solid long-term investment potential.

Total returns – the sum of gross yields and capital appreciation – are highest in Zones 3-6 for both flats and houses, at 9.5% and 9.3% respectively. For the most part, properties in Zones 3-6 show the highest gross yields for all property types and sizes as well.

Read the full report here, or read more about the London rental market in your area.