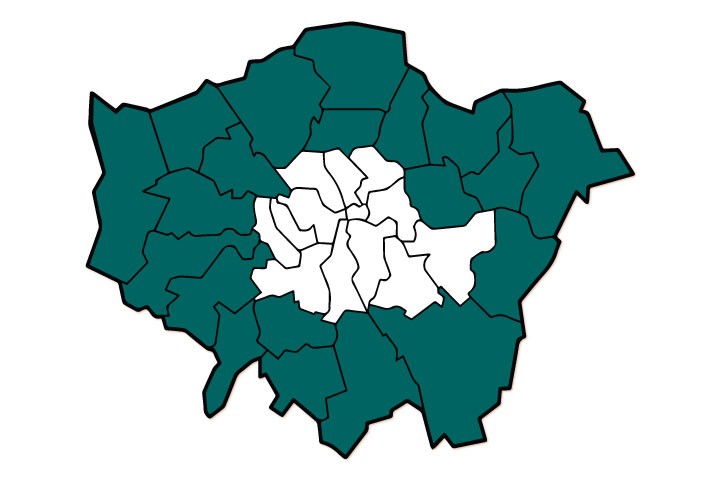

Outer London is defined as the boroughs shown in green on the map below and it is the areas within these boroughs where we think you can find the best property investments right now. Using our own lettings data and sales market data from Land Registry, we discuss exactly why it makes sense to invest in outer London.

More affordable property prices

London’s average property price currently stands at £485,380 and of the 20 boroughs defined as outer London, there are only six where the average property price is higher than the London average.

The most recent HPI Index results show that Barking and Dagenham, Bexley, Newham, Havering and Croydon are the most affordable places to purchase a property in London. And it is in these areas that there is strong demand for properties from investors and homebuyers, with the figures showing year-on-year sales volumes consistently over 82%.

Better return on investment

According to Foxtons’ letting data, gross yields for every rental property type in zones 3-6 in Q4 2017 were higher compared to those in zones 1 and 2, with the exception of 3+ bedroom flats – although this difference is minimal, with 3+ bedroom flats in zones 3-6 achieving an average gross yield of 4.5% and those in Zone 2 achieving yields of 4.8% in the same quarter.

"Capital appreciation is highest in zones 3-6"

The report also found that capital appreciation is highest in zones 3-6 at 3.7% for flats and 4.0% for houses – this compares to 3.2% and -6.7% respectively in Zone 1 and 2.9% and -0.1% for flats and houses in Zone 2.

And looking at the latest HPI Index figures, the top five boroughs with the highest year-on-year price increases are all located in outer London, with the exception of the London Borough of Lewisham – Merton, Redbridge, Bromley and Havering.

The highest average year-on-year price rises are for properties in Merton at 8.05%, which is nearly 2.8% more than the second highest average property price of 5.26% found in the London Borough of Redbridge.

Renters are now more flexible on location

Changes in the London rental market over the past 5-10 years have meant that renters are now more flexible in where they will live and are willing to take on a longer commute for the right property.

In the last quarter of 2017, zones 3-6 were the only zones to see an increase in the number of people searching for a property to rent. One of the reasons why there is an increased demand for properties in these outer zones could be the wide-scale regeneration of areas such as Croydon and Barking, which are being transformed into residential and retail hotspots.

Increased development means more demand

"Large regeneration schemes provide new, diverse investment options"

Although you will see new developments popping up in central parts of the capital, the amount of new development in London’s outer areas is much more widespread and on a generally larger scale.

Crossrail is just one example of how development in outer London is having a positive impact on the Build to Rent market, improving rail travel for residents and therefore increasing the amount of investment opportunity as demand for properties rises.

Read more about Buy to Let hotspots here.

There’s also more space to develop in outer London. Large regeneration schemes like Barking Riverside, with amenities, schools, parkland and a range of housing options, are creating thriving communities in their own right and new, diverse investment options.

For the long term, improvements to transport links, housing and amenities is great news for landlords, as demand for these outer areas is likely to increase year-on-year.

In conclusion…

Whether it’s affordability, return on investment or long-term growth you’re looking for, outer London is a sensible option for investment. However, London’s property market will always remain one of the most lucrative in the world, wherever you decide to invest.

If you want to learn more about a local area, see our guide to the current London property market.