For those who are thinking of becoming a landlord or expanding their existing portfolio, the London Lettings Report provides some interesting insight into the market. Here’s a quick overview.

London has been deemed the world’s most ‘magnetic’ city for the ninth year in a row, because it draws in people, capital and global business like no other city (Weform, 2020). When the pandemic and Brexit hit, demand fell, but renters love London. In the second half of 2021, despite the hurdles, demand rebounded for property in the world’s most magnetic city.

Confidence in the market

Ten years ago, the world was taking its first steps out of the Global Financial Crisis, and there was a cloud of uncertainty over the London property market. The residential property investors who braved it were rewarded – their investments rose by an average of 78% (59% net of inflation).

Ten years later, the feeling is oddly similar. Although Coronavirus and Brexit sparked uncertainty, we are seeing surprising promise in the London lettings market once again. In our database, we’ve uncovered an encouraging trend; “Thousands of people each year are looking for rental homes; in 2021 we saw a 57% increase in the number of lettings applicants versus 2020.” Times like these can present property investors with a unique opportunity.

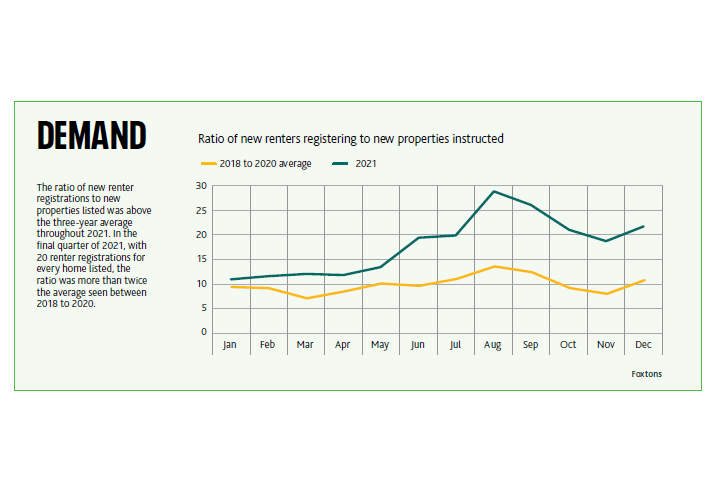

High demand

Our data shows that there were 20 renter registrations for every home listed in Q4 2021 – that’s more than twice the average from 2018 to 2020. There is an opportunity to consider becoming a landlord or expanding an already existing portfolio.

The ‘buy’ in buy to let

According to the Office of National Statistics, house prices have increased 78% in the past ten years, so a long-term relationship is a consideration, especially as current mortgage rates are so low.

Low mortgage rates

A discussion with a mortgage advisor might go a little differently this year. Even though there was a small rise in the base rate, it is still at a remarkable, historic low. Landlords are finding 5-year fixed-rate buy-to-let mortgages available at an interest rate of less than 2%.

For professional insight and a helping hand, our mortgage broker, Alexander Hall’s advisors focus on finding the most suitable mortgage for every situation. They work with lenders, big and small, to share a great range of options and negotiate with lenders, so every part of the process runs smoothly.

For professional insight and a helping hand, our mortgage broker, Alexander Hall’s advisors focus on finding the most suitable mortgage for every situation. They work with lenders, big and small, to share a great range of options and negotiate with lenders, so every part of the process runs smoothly.

Protecting investments

The management of property assets and the word ‘professionalisation’ have been used in relation to the Private Rented Sector lately, as landlords continue to manage rapidly increasing government regulations and renters’ expectations. To get reliable tenants, landlords need to provide the level of professional service they expect. In London, rents are also 9.6% higher in professionally managed than in non-managed tenancies.

Foxtons Property Management involves a team of experts working to protect London landlords' investments from check in to check out. They provide services like keeping a property up to date on compliance, handling property maintenance, arranging vetted contractors and managing tenant communication through My Foxtons. If you'd like to learn more, get in touch.

Foxtons Property Management involves a team of experts working to protect London landlords' investments from check in to check out. They provide services like keeping a property up to date on compliance, handling property maintenance, arranging vetted contractors and managing tenant communication through My Foxtons. If you'd like to learn more, get in touch.

Sources:

- Our data team analyse the Foxtons database, one of the largest databases of London property market information, every quarter to uncover trends for our London Lettings Report. We build this report in conjunction with Dataloft, a property market intelligence company, for an in-depth analysis of the current market.

- For more information on the process to becoming a landlord and our managed services, get in touch with Foxtons Property Management.

- For more information on your mortgage options, get in touch with Alexander Hall.