London needs more homes across the board. Whether you’re an investing landlord looking to help supply greatly needed rental stock in the coming years, or you’re wondering how to start your own journey up the property ladder with the market’s current challenges, there’s an opportunity here that’s not got near enough attention.

Do you dream of owning a home?

✔ Lower energy bills

✔ Appliances under warranty

✔ Incredible amenities

✔ An on-site management team…

See why so many first-time buyers prefer new-build homes.

Many renters plan to buy at some point in the future. After all, who wouldn’t want to own a home in London?

However, if you’ve got a good thing going in your rental now or if the current mortgage situation has put you on the back foot – in essence, if you have some flexibility between when you commit to your purchase and when you complete it – you should consider buying off-plan.

It is actually a great time to do so, because you can lock in your price now, and continue saving to complete your purchase when the development is built in a few years' time (by which time the market may improve).

What does it mean to buy off-plan?

Buying off-plan means you’re purchasing a property that has not yet been built, directly from the housebuilder. Before the foundations are laid, developers already have us communicating with homebuyers and investors who start their searches with Foxtons because:

• We have an excellent network of London’s top developers, so buyers have access to the most innovative and highly anticipated homes coming to the Capital.

• There are some excellent incentives available to motivate early buying.

• The result is an all-new home with everything inside designed, built and installed for modern living – you won’t get that on a period conversion.

• Developers we’ve worked with have previously backed incentives allowing potential buyers to retain the same purchasing power they had in a more favourable market, i.e. before interest rates rose.

Why now?

Buy off-plan, and you’ll have your own brand-new home in one to three years, depending on the development. This means you will be locked in at today’s price for London property, and then you’ve got the next 12–36 months to plan your finances, save up for stamp duty or save a larger deposit.

Of course, it’s impossible to know for certain what the market will do in the next few years. There is potential, as we've seen in the past, for interest rates to drop. This would benefit an off-plan purchase even more, as you’ve already secured your property at a cheaper price. There’s also strong potential for house prices to rise in the coming years, increasing the value of your new asset.

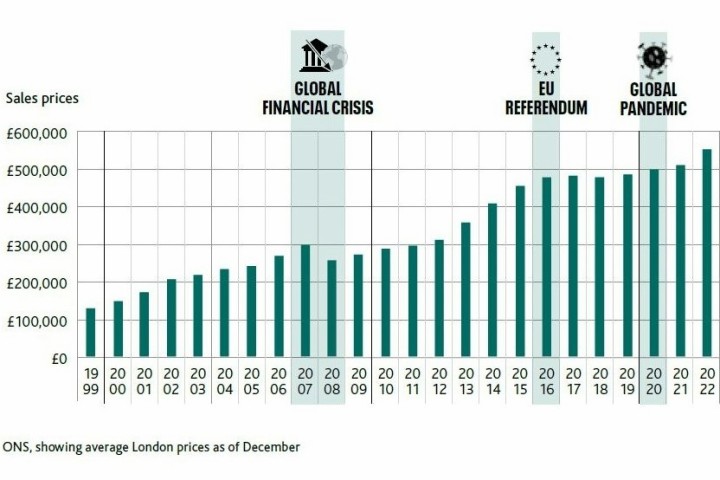

Our latest London Report showed how the property market in London has grown over the last two decades. Since 1999, London house prices have risen 6.5% per year, on average. In that time, we have faced a global financial crisis, the EU referendum and a global pandemic, yet property values have still risen steadily over the past 20 years.

The benefits for buy to let

If you are a landlord looking to increase your portfolio, there couldn’t be a better time to do so, and not just for the reasons above.

There is a large national focus on London’s need for new homes to meet the rising demand. In a recent Financial Times article, which describes the state of the London lettings market, Foxtons CEO said:

“This is the worst supply and demand balance we have ever seen, and it’s only going to get worse,” says Guy Gittins, chief executive of Foxtons. In April, the agency had 97,000 tenants chasing after just 2,000 available properties.

The London market is well documented for its resilience – people will always want to live here. Developers and homebuilders are under great pressure now to meet the demands of the coming years’ rush, so it is an understatement to say these homes are highly anticipated. If you plan to be a part of London’s answer to ever-increasing rental demand, get in touch with our New Homes team.

As well, Foxtons have comprehensive lettings services – excellent property management, negotiators dedicated to minimising the void period, financial advice through our specialist partners at Alexander Hall – we will provide whatever support you need.

Future proof

The government is working towards net zero carbon emissions and setting rigorous targets for London residential property. Landlords and buyers can get ahead of the game by investing in new homes, as “Close to nine in ten new build apartments in London met the highest Energy Performance Certificate (EPC) ratings of ‘A’ and ‘B’ in 2022, in contrast to the resale market where over 80% were rated ‘C’ or ‘D’” (The London Report 2023).

Best areas to invest in London property

Two out of five Foxtons buyers and renters move to a different location than their initial search (The London Report 2023). Because so many Londoners are open to moving to find their home, there is a huge amount of potential in regeneration projects. The best part about buying a new home off-plan is the opportunity to get in early and invest in up-and-coming areas of London.

For example, we have a huge range of investment properties available from the Berkeley Group, who has a knack for bringing new homes into successful regeneration projects. Berkeley’s Royal Arsenal Riverside was built as part of Woolwich’s award-winning regeneration scheme, with incredible results for the local economy. Watford is currently going through a major regeneration, which includes a whole host of exceptional new developments to take advantage of its business park and excellent transport links.

Your dream home in the making

New developments are being dreamed up by housebuilders in most every pocket of central and greater London. With 60 offices across London and a vast network of developers through our dedicated New Homes department, we will find the perfect home for your requirements, well before it hits the market.

Foxtons Head of New Homes & Investments said, “For example, buyers need to have the 20% deposit ready. But for some buyers, we have been able to negotiate paying the deposit in stages. So, the developer was able to exchange on 10% and the buyer paid the other 10% over the following 12 months. It’s just to say, if you’ve got a vision of where you want to be in three years, we’ll help make it happen.”

Flexibility is a clear advantage to buying your new property through our network of professional developers. Another example is contract assignment sales. Maybe you’ve bought a home to be completed in three years’ time, but in that time, your situation changes – maybe you need to relocate for a work opportunity. You have the right to sell the contract to a new buyer.

Ready to take the next step?

If you want to buy a new home off-plan, either to make a smart first step onto the property ladder or to expand your lettings portfolio, get in touch. We have plenty of upcoming developments all over London we’d be happy to introduce you to.